The capital of Rajasthan, Jaipur, is fast emerging as a hub of financial services, playing host to a clutch of finance companies that dish out loans, provide investment solutions, and manage wealth—not to mention offering insurance for almost anything. These firms, barring a few, cater to the mass unsecured credit segment and to SMEs.

While the Rajasthan government paints a rosy picture about the state’s growing credit profile, with a 12% growth in 2023 alone, the truth is that a large part of that is being propelled by finance companies in Jaipur. And you can bet your last dirham that this city is going to outshine the others in Rajasthan on all parameters in the coming years.

Why Jaipur Is a Preferred City for Financial Companies

Due to its strategic location, its growing economy, and its business-friendly environment, Jaipur is becoming a desired city for financial companies. Government’s individuation of the push for digitalization and startup support has attracted fintech and NBFC firms, and the emerging IT and industrial forties are creating strong demand for financial services. So, for the better part of a decade now, I have been talking to a number of financial services companies about potentially locating some or all of their operations in Jaipur.

1. Strategic Location and Connectivity

Jaipur has terrific air, rail, and road links to the major Indian cities of Ahmedabad, Delhi, and Mumbai. These fantastic connections make it a breeze for many businesses to operate in and grow into this city. Jaipur stands close to the National Capital Region (NCR), which is flooded with operational and logistical advantages, making the city easy to access and hard to resist as a destination for financial firms.

2. Skilled Workforce at Lower Cost

Jaipur boasts a large pool of talented, qualified professionals, thanks to the many colleges and universities in the city and around it. Compared with such large urban centers as Mumbai and Delhi, the labor force and the physical plant in Jaipur are much less expensive.

3. Supportive Government Policies

The Rajasthan government has taken several steps to promote entrepreneurship and attract investment from financial institutions. Numerous policies have been enacted, with policies pertaining to startups being very much in vogue. These make it a lot simpler to get a new business off the ground in the state.

4. Increasing Financial Services Demand

Banking, insurance, and investment firms have a great chance to establish themselves in Jaipur’s quickly growing economy, which is fueled by tourism as well as the expansion of manufacturing, IT, and real estate. This is mostly due to the fact that startups and small and medium-sized businesses (SMEs) in this area mainly depend on financial institutions for advice and funding as they look to expand.

5. Rise of Fintech and Digital Adoption

The increasing internet access and smartphone usage in Jaipur offer a range of digital financial services. We are now embracing these services, and it seems that penetration into our market has reached a level that is swaying our people toward the kinds of bases that fintechs are setting up here.

List of Top 10 Best Finance Companies in Jaipur

1. Angel One

Angel One Limited, previously Angel Broking, is one of India’s largest fintech & retail stockbroking companies, and was founded in 1996. Based in Mumbai, it offers services built on digital platforms, including equity, commodity, and currency trading; mutual funds distribution; and margin funding.

Angel One currently has more than 29 million clients and uses AI and data science to enhance the user experience with its tools, such as ARQ Prime and SmartAPI. The company has been recognized as one of the best workplaces in India, and continues to innovate in financial services to provide better access, provide better financial services, and better personalized investment solutions.

Services:

- Broking stocks

- Investment Advisory

- SIPs and mutual funds

- The MTF, or Margin Trading Facility

- API Trading, or SmartAPI

- Debt Secured by Stock

2. SunCrypto

Founded in 2021 and headquartered in Jaipur, SunCrypto is a top Indian cryptocurrency exchange run by Angelic Infotech Private Limited registered with the Financial Intelligence Unit of India (FIU-IND). It provides a safe venue for trading over 350 coins, including INR and USDT pairs.

With multilingual support, SunCrypto serves Tier-2 to Tier-4 cities and prioritizes user-friendly interfaces. Security measures involve backing $150 million of insurance and keeping 85% of user cash in cold wallets protected by Ledger. Features like Crypto SIPs, staking, and automated trading are offered also on the platform.

Services:

- Trading Cryptocurrencies

- Crypto SIPs, or systematic investment plans

- Services for Staking

- Trading with Bots

- Assistance with Taxation

- Learning Materials

- Easy-to-use Platform

- Safe and Guaranteed Storage

- Adherence to Regulations

3. NetAmbit

Based in Noida, India, NetAmbit ValueFirst Services India Pvt. Ltd. is a prominent financial services distribution and sales outsourcing company. Founded in 2000, NetAmbit serves sectors like fintech, edtech, e-commerce, and healthtech with controlled sales processes, call center solutions, and staffing services. Partnering with industry leaders like Google, Amazon, HDFC Bank, and Flipkart, the company helps brands to improve their offline reach with a staff of more than 20,000 spread over nearly 900 cities. NetAmbit aims to democratize financial services and so guarantee that companies all across have access and sustainable growth.

Services:

- Oversaw the sales process

- Services for Call Centers

- Solutions for Staffing

- Distribution of Financial Products

- Fulfillment of Digital Leads

- Development of Franchises

4. Fincare

Fincare SFB, created in 2017, was a Bangalore-based digital-first bank focused on financial inclusion for underserved regions all over India. Among its products were fixed and recurring deposits, microfinance, gold loans, tiny business loans, savings and current accounts. Fincare SFB has a significant presence in South and West India, serving about 5.4 million customers through more than 1,200 banking branches spread throughout 23 states and union territories.

Starting on April 1, 2024, Fincare SFB joined AU Small Finance Bank to develop a pan-India retail banking company aimed to boost financial inclusion and broaden services across the country.

Services:

- Savings accounts

- Current accounts

- Fixed deposits

- Recurring deposits

- Microfinance sector loans

- Gold loans

- Small business loans

5. WorldQuant

Founded in 2007 by Igor Tulchinsky, WorldQuant is a global quantitative asset management firm. Its headquarters is in Old Greenwich, Connecticut, but it has 26 other offices around the world. These offices alone host over 900 employees, not counting the untold number of employees that virtual offices probably have.In fact, the company’s website states that it employs over 1,000 people across 27 offices.

That represents a substantial increase in headcount compared to the firm’s founding seven years ago, even if we assume that the Old Greenwich, Connecticut, office is nearly fully staffed! More importantly, the firm is supposedly using that headcount wisely—to run what seems to be, to this point, a quite successful operation in terms of stock picking across asset classes in global markets.

Services:

- Management of Quantitative Investments

- University of WorldQuant

- WorldQuant Ventures

- Predictive WorldQuant

- Learning WorldQuant

6. Citigroup

Core banking division of Citigroup. New York City is home base. Begun in 1998 by a merger with Travelers Group. Includes Citigroup and concentrates on institutional services, credit cards, and consumer banking. Offers retail banking, wealth management, and investment banking in over 160 nations.Citicorp Finance (India) Ltd. runs in India and offers corporate loans, loans against securities, and commercial real estate financing.As of 2024, it emphasizes digital innovation and global financial solutions.

Services:

- Group of Institutional Clients (ICG)

- Services for Citizens

- The Citi Private Bank

- Initiatives for Digital Transformation in India

Also Explore some Finance Companies in 2025:

Finance Companies in Bangalore

7. Mufin Green Finance Limited

Established in 2016 and based in New Delhi, Mufin Green Finance Limited is the first openly traded green finance firm in India. Under the control of the Reserve Bank of India is an NBFC, or Non-Banking Financial Corporation. Working as a subsidiary under Hindon Mercantile Limited, Muffin has specialized in extending loans to EVs (electric vehicles), EV charging infrastructure, and swappable batteries, which promote clean and sustainable transportation, and to technologies which would extend those means of transport to rural and semi-urban parts of the country, thereby significantly increasing the number of people who can make use of such means.

Services:

- Finance for Electric Vehicles (EVs)

- Funding Infrastructure

- Finance for Swappable Batteries

- Social Impact Projects

- A Digital and Physical Method

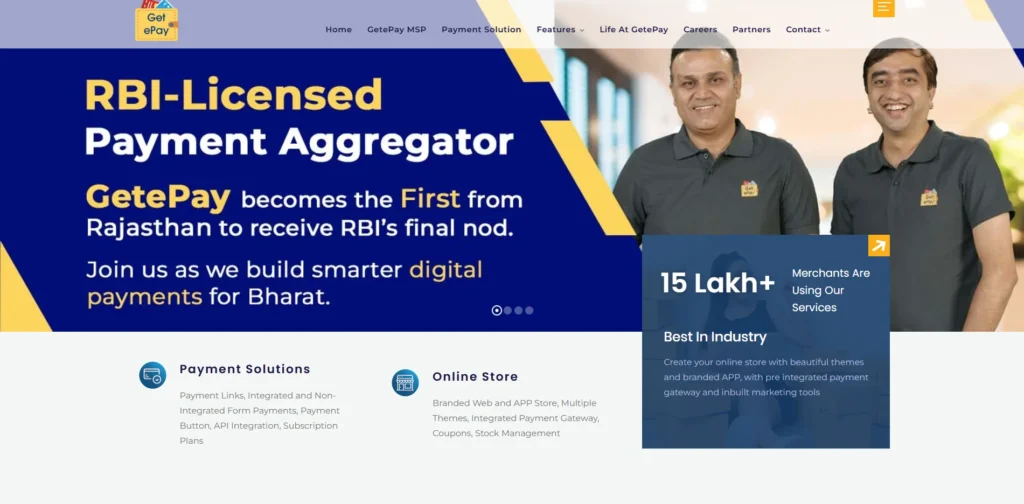

8. Getepay

Founded in 2016 by Pravin Sharma, Gatepay is Jaipur-based fintech platform. It concentrates on providing a variety of digital payment and commerce solutions for little and medium-sized companies (SMEs) located all across India. Its services include, among other things, UPI QR codes, the payment gateway, invoicing, and subscription billing, which should give every sort of merchant an option for receiving payments.

In 2025, Getepay became the first company from Rajasthan to receive the Reserve Bank of India’s Payment Aggregator license, which offers a sort of credibility boost in the fintech sector.

Services:

- Solutions for Digital Payments

- Tools for Business Management

- GetePro for Workforce Management

9. AU Small Finance Bank Limited

AU Small Finance Bank Limited, based in Jaipur, is the top tech-led small finance bank in India. Established in 1996 as AU Financiers, it remade itself as a scheduled commercial bank in 2017. The bank zeroes in on low- and middle-income individuals and on micro and small businesses, serving what it characterizes as an “underserved” segment of the market. In addition to fundamental banking products like savings accounts and fixed deposits, its financial portfolio comprises a broad spectrum of loans from personal loans to business loans to vehicle loans. It also supports entrepreneurs exploring low-cost business ideas in Bangalore and other growing urban markets through accessible financing and advisory services.

The bank had expanded its wings to 2,383 touchpoints over 25 states and union territories as of December 2023; it employed around 46,000 employees and had nearly 1.1 crore consumers among its expanding family. And it has amassed quite a few awards: The bank earned a spot on the Fortune India 500 list and has been recognized for excellence in a number of other venues, mostly for its customer-centric innovations.

Services:

- Affluent Banking & Wealth Management

- Payment Solutions & Cards

- Business and Commercial Digital Banking

10. Aavas Financiers Limited

Aavas Financiers Limited was set up in 2011 in Jaipur, with the intention of offering housing finance products for low- and middle-income groups in India, particularly in the semi-urban and rural areas. The company, in other words, considers home loans as its centerpiece and offers construction loans, home improvement loans, home purchase loans, and loans secured by real estate to its clientele-all for home purchase work.

As of March 2024, Aavas had over 370 branches across 14 states in India. The company’s Assets Under Management (AUM) stood for nearly $2 billion, or ₹17,167 crores as on March 31, 2024.

Services:

- Products for Home Loans

- MSME & Business Loans

- LAP, or loan against property

- Loans for Rural Housing

- Digital Services

Challenges Faced by Finance Companies in jaipur

- Talent Shortage: Compared to the metro hubs, Jaipur lacks specialized finance professionals, which limits the expertise.

- Digital Infrastructure Gaps: The fintech scalability is affected by the digital tools that are adopted at a slower pace in the semi-urban and rural sectors.

- Customer Awareness: A lack of financial knowledge can slow the customer onboarding process and undermine trust in financial products.

- Regulatory Compliance: Maintaining rigorous RBI and financial regulations necessitates keeping updated and putting in place constant compliance measures.

- Market Competition: The rising number of banks, NBFCs, and fintech startups means more competition, and that means lower profit margins.

Career Opportunities in Finance Companies in jaipur

- Financial Analyst: Examine market movements, construct fiscal templates, and support in putting money matters right.

- Accountant: Supervise financial matters including budgets, tax obligations, audit requirements, and fiscal reports.

- Loan Officer: Assess and carry out the necessary steps to grant loans to people and companies.

- Relationship Manager: Establish and sustain client connections, advocate financial services.

- Credit Analyst: Evaluate the worthiness of credit and the probability of risk for decisions involving lending.

- Operations Executive: Manage backend processes, adherence to rules and regulations, and paperwork.

- Sales & Marketing Executive: Market banking and finance products to customers.

- Fintech Developer: Create online instruments and portals for monetary service providers.

Conclusion

Jaipur, because of its advantageous business atmosphere, skilled workforce, and ever-improving infrastructure, has become a rising base for finance companies in Jaipur. We have here, from the large and well-known AU Small Finance Bank to the relatively smaller (but also well-known) Aavas Financiers, the big players in a hub that includes a range of not just Personal Loan and Housing Finance services but also quite a few Digital Payment and SME-NBFC players.

Jaipur is relatively well-located in terms of its access to the western part of India, with its attractive physical infrastructure compared to any city it’s situated near, plus the added appeal of low-cost digital access to the sorts of services and financial instruments that the fintech world now offers.

FAQS

1. What kinds of services can Jaipur provide by Finance Companies?

Finance companies in Jaipur generally cater to the whole spectrum of loans-home loans, personal loans, business loans, vehicle loans, and loans against property. The city has companies that give magna cum laude MSME Finance, gold loan, and microfinance service too.

2. Are Finance Companies in Jaipur restricted under RBI?

NBFCs operating in Jaipur must basically be registered with and regulated by the RBI. However, those operating as housing finance companies are also under the purview of the National Housing Bank (NHB).

3. What are the documents required for applying for a loan from the Finance Company?

Most of the companies require:

- Identity proof (Aadhar, PAN, Voter ID)

- Address proof (utility bills, ration card)

- Income proofs (salary slips, bank statements, Income Tax Returns)

- Photographs and documents of property (for secured loans)

4. How can I pick Jaipur’s top Financing Company?

Look for companies that offer:

- Competitive interest rates

- Clear processing charges/fees

- Good customer service

- Good user reviews

- Some examples are AU Small Finance Bank, Aavas Financiers, and Getepay (for electronic payments).

5. Can I get a loan if I do not have documented proof of income in Jaipur?

Yes, some finance companies like Awas Financiers offer customized appraisal techniques to borrowers without formal income proof, mainly targeted at self-employed and rural/semi-urban borrowers.