Mumbai is India’s financial hub, boasting over 3,000 registered financial institutions and organizations, ranging from large international banks to emerging fintech startups. The city is home to some of India’s largest finance companies in Mumbai, such as HDFC Bank, ICICI Bank, and Kotak Mahindra Bank, which are key contributors to the national GDP. Recent studies show that Mumbai handles nearly 25% of all banking transactions in the country, making it a preferred destination for NBFCs, asset management companies, and insurance firms.

With strong infrastructure, a skilled workforce, and a sound regulatory framework, finance companies in Mumbai continue to grow and attract investment from both domestic and global markets. As the financial industry embraces digital transformation, Mumbai remains at the forefront of economic growth and financial innovation.

Why Mumbai Is a Preferred City for Financial Companies

Mumbai has been the first choice for financial companies. The city has a large talent pool, great connectivity, and a dynamic business atmosphere that encourages growth and innovation. Also, we have government initiatives, regulatory bodies, and fintech startups, which add to Mumbai’s appeal. All these put together make Mumbai the ideal base for financial operations, which in turn attract both large-scale and new-age players in the finance sector.

1. Financial Hub of India

The city houses the Reserve Bank of India, Bombay Stock Exchange, and a number of banks and NBFCs, thus becoming the financial activity hub.

2. Workforce with Skills

The city attracts the cream of the country, with finance professionals being whipped up by IIM and NMIMS.

3. Connectivity and Infrastructure

With an international airport, suburban railway, and metro, Mumbai offers efficient connectivity for business-related activities.

4. Business Ecosystem

Not just corporate hubs, law firms, and fintech startups, Mumbai has a dynamic ecosystem for financial growth.

5. Global Presence

Many of the multinational banks and investment houses have their Indian offices in Mumbai, thus rendering it even more vital to finance internationally.

Top Finance Companies in Mumbai

1. HDFC Bank

HDFC Bank is one of India’s largest private sector banks with a popularity for its wide range of reliable and innovative financial products. It is dedicated to offering customer-centric solutions through the mix of technology and people service. With the focus on convenience, transparency, and confidence, the bank addresses millions of consumers and commercial businesses.

Current and savings accounts, business and personal loans, credit cards, and wealth management are some of the numerous banking services provided by HDFC Bank. It also offers digital banking platforms with ease of transaction and 24×7 accessibility. With a strong belief in financial development and inclusion, HDFC Bank is a customer’s first point of contact for safe and easy financial services.

Services Offered:

- Personal Banking

- Business Banking

- Corporate Banking

- Loans & Credit Cards

- Wealth Management

- Digital Banking

2. ICICI Bank

Constellation, while showing a strong partnership of finance and customer orientation, ICICI Bank is one of India’s private sector giants. It offers classical banking yet with a touch of technology to a verging mass of customers including individuals, small businesses, and large enterprises.

The bank’s wide array of services includes personal banking, corporate banking, NRI services, loans and credit cards, and wealth and investment management. It is also famous for the dawn of digital banking with unique innovations like iMobile Pay and Internet Banking for 24×7 access. Also, nursed with the spirit of financial inclusion, efficiency, and safety, ICICI Bank remains a reliable companion on the financial highways of millions.

Services Offered:

- Personal Banking

- Corporate Banking

- NRI Banking

- Loans & Credit Cards

- Wealth & Investment Management

- Digital Banking

3. Kotak Mahindra Bank

Kotak Mahindra Bank stands apart from the other main private Indian banks by providing cutting-edge financial services and banking options. Their offer includes fixed deposits, savings accounts, loans, wealth management, investment products, personal banking services, as well as insurance. By means of technology, the bank hopes to provide a smooth internet banking platform enabling customers to handle their finances as well as wherever they want.

Also, Kotak Mahindra Bank designs financial solutions for corporate and SME clients providing services like trade solutions and working capital finance. Millions of customers see the bank as one of the best choices for new banking and investment products because of its focus on customers, openness, and new ideas.

Services Offered:

- Personal Banking

- Business Banking

- Corporate Banking

- Investment Services

- Insurance Products

- Wealth Management

- Digital Banking

- Credit Cards

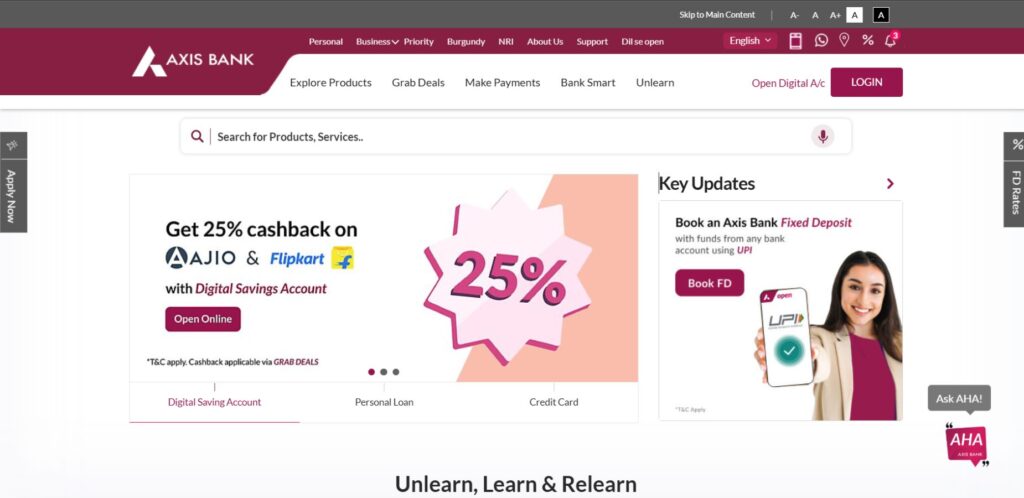

4. Axis Bank

Axis Bank One of the moving private sector banks in India Axis is a financial institution with offers some of varied services and products to corporate, retail and SME banking clients in India. Axis Bank wants to offer state-of-the-art technology, superior customer service and a new age banking experience to its customers.

Asset management, retail banking (loans, credit cards, and savings accounts), and commercial banking (working capital, trade finance) are among the services provided by Axis Bank. Investment banking, insurance, and round-the-clock available digital banking systems facilitating easy transactions are provided by it. Axis Bank, with its extensive network, aims to spread financial inclusion as well as economic growth in India.

Top private sector bank Axis Bank offers the entire spectrum of financial services to customer segments covering Large and Mid-Corporates, SME, Agriculture and Retail Businesses. Axis Bank address the needs of its millions of customers all across the nation through the focus on customer care and a robust online outreach.

It offers savings and current accounts, personal and business loans, credit cards, and investment products. The bank also plays an important role in corporate banking, asset management and forex services. Rising to the heady heights by putting great emphasis on financial inclusion and digital technologies, Axis Bank still remains on top by offering secure, faster, and most reliable banking options.

The bank is also a player in corporate banking, asset management, and forex services. Focused on driving financial inclusion through digital innovation, Axis Bank still remains a market leader in digitized, secure and convenient banking.

Services Offered:

- Personal Banking

- Business Banking

- Corporate Banking

- Loans & Credit Cards

- Asset & Wealth Management

- Digital Banking

- Forex & Treasury Services

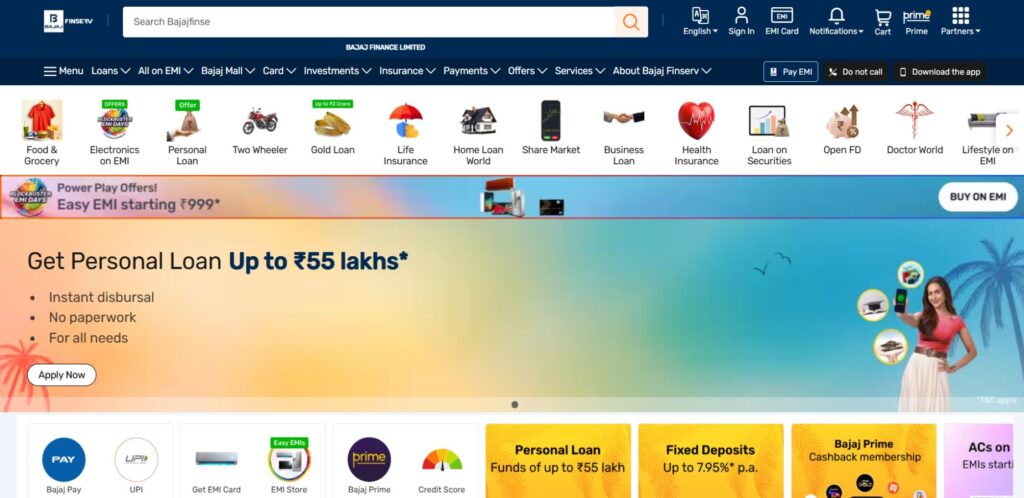

5. Bajaj Finserv

India’s one of the best non-banking financial companies (NBFC), Bajaj Finserv offers an array of financial services and products. Many educational researchers worry about the impact social media has on how students do in school. Several studies show that people who use platforms too much often have poor grades and find it harder to remember class information.

A group of 500 undergraduate students showed that those who spent more than three hours each day on social media earned 15% less on exams than those using social media less. It is most obvious when exams are approaching, since anything that distracts you can be very damaging.

Although social media lets students connect easily and find information, the results suggest they should limit their use during important school times. More research is needed to find good ways to control our use of digital technology.

Services Offered:

- House Loans

- Loans for Businesses

- Durable loans for consumers (EMI financing)

- Life Insurance

- Health Benefits

- All-inclusive Insurance

- Wealth management, including retirement planning, fixed deposits, and mutual funds

- Approval and Administration of Digital Loans

- Advisory Services for Investments

6. Tata Capital

One of Mumbai’s most well-known non-banking financial firms is Tata Capital Limited. In 2007, it was introduced. The firm, which is a unit of Tata Sons and functions under the brand name Tata Group, offers a variety of financial services and products to corporate and institutional clients as well as individual customers all over the country.

Customer satisfaction and product innovation are two of the company’s main areas for the future. They have pledged themselves to customer satisfaction and the use of cutting-edge technology in their product offerings.

Services Offered:

- Wealth Management & Investment Services

- Business & Commercial Finance

- Consumer Finance

- Insurance & Protection Plans

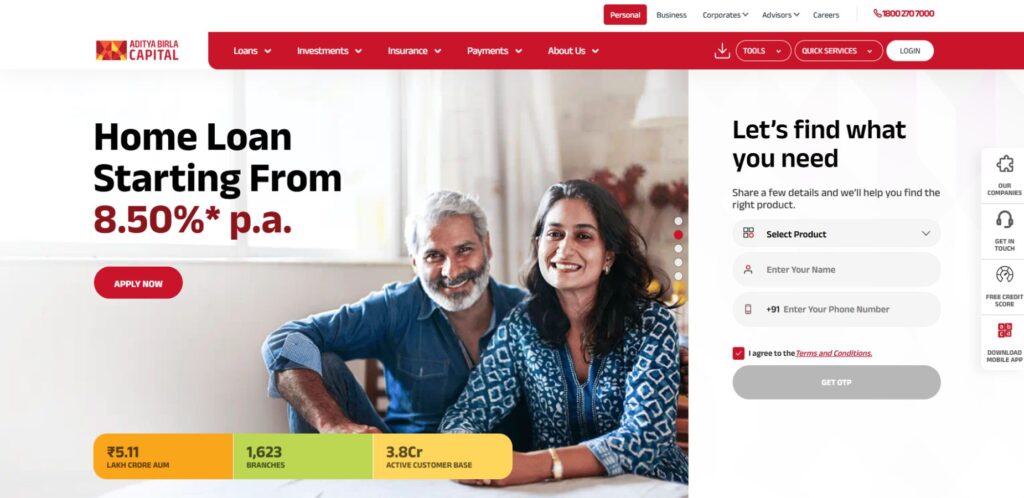

7. Aditya Birla Capital

Aditya Birla Capital Limited (ABCL) is not a bank but remains the most trusted financier in India and an anchor for other financial services businesses within the Aditya Birla Group. Together with its 59,000 plus staff, ABCL has a footprint of 1,482 branches that are complemented with more than 200,000 agents and channel partners across India.

ABCL had assets under management (AUM) in excess of INR 5.03 lakh crore and a combined loan book of more than INR 1.46 lakh crore as at December 31, 2024. ABCL is a one-stop-shop for financial services like loans, investments, insurance, and payment services that are utilized by various customers at different stages of their life journey.

Services Offered:

Offering a panoply of non-deposit-taking financial services that are called Non-Banking Financial Company (NBFC) services

- Protection coverage for life and general insurance

- Acquiring holdings in Mutual Funds

- Managing fundraising and wealth

- Providing loans (personal, business, and home loans)

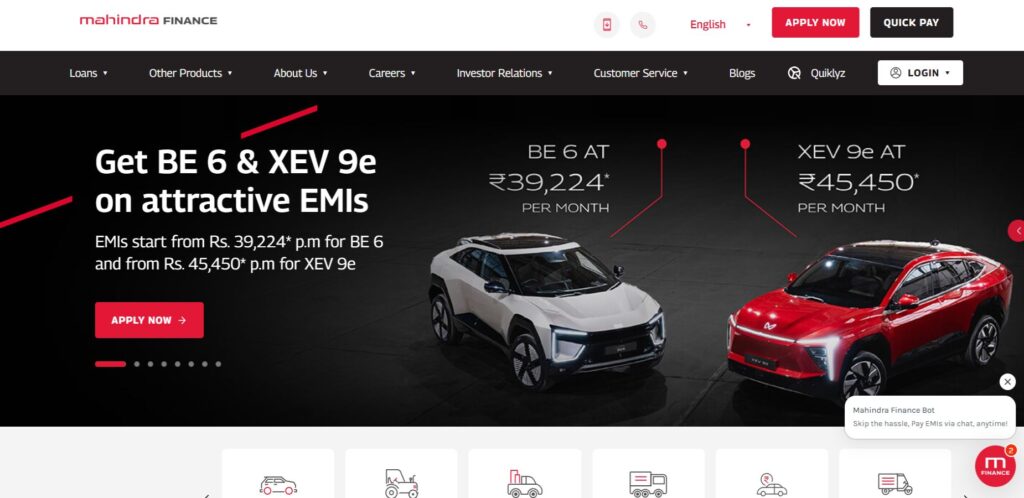

8. Mahindra Finance

Mahindra & Mahindra Financial Services Limited, better known by the name of Mahindra Finance, was set up in 1991 in India, and it is a well-known non-banking financial company (NBFC). It is the business wing of the Mahindra Group and is primarily concerned with the provision of financial services that cater to the demands of rural and semi-urban areas.

At the moment, 1.386 offices are registered in 7.000 towns and 380.000 villages in India. The company has achieved assets under management of 82,770 crore rupees which gives them more than 9 million customers with the support of that amount of money.

Services Offered:

- Vehicle Loans (two-wheelers, tractors, commercial vehicles)

- SME Loans for rural businesses

- Agriculture Equipment Financing

- Home Loans

- Insurance Services

9. L&T Finance Holdings

L&T Finance Holdings Ltd. (LTFH), located in Mumbai, is actually one of the largest NBFCs in India. The 17th of December, 2023, saw the reorganization of LTFH by the integration of three of its subsidiaries, namely L&T Finance Ltd., L&T Infra Credit Ltd., and L&T Mutual Fund Trustee Ltd., into a wholly financial services company L&T Finance.

This is part of LTFH’s strategy to simplify operations and improve control. LTFH provides various financial products like personal loans, two-wheeler, and home loans, rural business and farm loans, and SME financing. Also, they serve with high-quality customer service. The firm with an excess of 2.4 crore customer base and a huge distribution network of 13,000 plus touch points are focused on making customer’s lives better.

Services Offered:

- Rural Finance

- Housing Finance

- Infrastructure Finance

- Corporate Finance

- SME Loans

10. IDFC Bank

One of the top private sector banks in India, IDFC FIRST Bank was established in 2018 by the merger of IDFC Bank and Capital First, and has its headquarters in Mumbai. The bank, which has more than 38 million customers scattered across 60,000 outlets in India, has a mission of ethical, digital, and socially responsible banking.

The services it provides include both retail and corporate banking, lending, credit cards (including personal loans), and wealth management. In particular, IDFC FIRST Bank provides savings accounts at zero-cost rates and a monthly interest rate. One of the world’s top mobile banking applications showcases this digital excellence.. (Photo by Nikki Sengg)

Services Offered:

- Savings and Current Accounts

- Personal and Business Loans

- Credit Cards

- Fixed Deposits

- Corporate Banking Solutions

Challenges Faced by Finance Companies

1. Compliance with Regulation

Financial services in Mumbai experience strict regulation by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) in terms of the regulatory departments. The rules are regularly updated to improve the financial situation in the country and to protect the customers.

2. Over-the-top Competition

India’s financial hub, Mumbai, has a high concentration of home-grown as well as international finance companies, banks, NBFCs, and fintech startups. This creates very competitive environments in which organizations must innovate incessantly to stay competitive. In a bid to acquire and retain customers, organizations will compete on loan rates, ease of use on the internet, customer care, and value-added products.

3. Credit Risk

Mumbai has both salaried professionals as well as a large proportion of small-scale workers and businessmen. Although it provides lending opportunities, it also subjects finance companies to high credit risk. It is challenging to assess creditworthiness in situations where there is no formal proof of income.

Apart from economic cycles, such as inflation, redundancies, or sector-wise falls, defaults could increase. Small and medium-sized enterprises (SMEs), being a significant segment of borrowers, are vulnerable to interruptions.

4. Cybersecurity Threats

With the rise of fintech services and digital banking, finance companies in Mumbai face more cybersecurity threats. Hacker groups target customers’ information, online payment facilities, and internet-based banking systems to result in data breaches, identity fraud, and financial loss.

Ensuring data privacy, IT infrastructure security, and compliance with cybersecurity norms calls for continuous investments in high-technology equipment and qualified manpower.

5. Operations Costs

Mumbai ranks among India’s most expensive cities when it comes to real estate and lifestyle. Finance companies operating here have enormous overhead expenses, including rentals of their office space, salaries of their personnel, electricity bills, and maintenance of the infrastructure. Hiring top-notch financial personnel also costs more due to the nature of competition in the market.

Career Opportunities in Finance Companies

1. Financial Analyst

The finance industry, where financial analysts analyze financial data to make business decisions. They assess investments, forecast future earnings and expenses, analyze current market conditions (e.g., demand patterns), and develop financial models. These analysts help businesses improve profitability through strategic planning, budgeting, and risk management.[MLB].

2. Risk Manager

The role of a Risk Manager in assessing and mitigating financial risks that could harm monetary profits and reputation is crucial for achieving this objective in financial firms. Market trends, credit risks, and operational weaknesses are studied to develop strategies for limiting losses.

Risk Managers are responsible for ensuring that the company adheres to regulations and maintains financial stability. Senior executives, auditors, and regulatory agencies are frequently in collaboration with them. For this position, candidates should have strong analytical skills and an ability to read fine print as well as being from a school of finance, economics or even statistics.

3. Investment Banker

Their most important partner is an investment banker, who helps governments and businesses raise capital, control financial risks, and execute strategic deals such as mergers and acquisition. They scrutinize financial figures, create detailed reports, and provide in-depth analysis of potential investments.

The demanding work of investment bankers necessitates ongoing education on economic and market developments. It’s a career opportunity with high potential for big businesses, substantial earnings and exposure on an international platform.

4. Loan Officer

Because they are meant to review, approve, or recommend loans, loan officers inside financial institutions are quite important. Sometimes loan officers have to counsel people and companies about their financial condition and whether they are qualified for loans.

For loan officers, necessary qualities include competent client service, analytic ability, and careful attention to detail. They offer advice on lending, perform loan evaluations, spot possible loan options, among other things, and ensure compliance with all policies and banking rules.

5. Wealth Manager

A wealth manager to provide full financial support for the high. Their duty is to create tailor-made strategies for investment, retirement planning (fortunes), taxation and estate preparation, and risk management. Building relationships with clients is a key advantage of wealth managers in managing complex planning and management.

Their financial services are complemented by tax experts, analysts, and legal advisors. They also offer comprehensive advisory services. A strong aptitude in analysis, financial knowledge, and interpersonal skills is necessary for the position. In addition, Wealth Managers have the opportunity to secure high-paying jobs with promising career opportunities and ongoing client engagements in a variety of banks, investment firms or finance companies.

You may also read: IT Companies in Mumbai

Conclusion

Finance companies are the best in increasing economic growth through their top-notch financial services that could meet the needs of individuals, companies, and institutions. Customers are greatly favored with one-to-one solutions, digital experiments, and secure money supply through prominent organizations like HDFC Bank, Tata Capital, and Kotak Mahindra Bank.

Not only do these establishments guarantee that everyone has access to the financial system, but they also contribute stable and fulfilling careers for those who are eyeing it in the sector. The range of services that finance companies offer including loans and insurance, wealth management, and fintech solutions demonstrate that they still adapt to the changing needs of the market.

In their honest and genuine customer interaction and the use of technology, companies are able to be the most trusted friends and guides in the journey of financial success. The rise of the Indian economy signals the continuing climbing of the demand for the best finance institutions as well as the expansion of the finance professionals’ skills. The finance organizations’ customer-oriented model, technology, and open conversation with clients are features that make people trust them as partners in their financial success.

FAQS

1. Mumbai finance firms provide what sorts of financial services? hey have a rather wide range, including:

You can obtain personal loans, home loans, car loans, business loans, etc. Offerings include mutual funds, wealth management, and portfolio management.

Insurance: You have access to general insurance, health insurance, and life insurance items.

Banks like HDFC Bank and ICICI Bank provide debit and credit cards.

2. Does the government oversee financial firms in Mumbai?

Indeed. Yes, definitely. The Reserve Bank of India (RBI) and other regulatory authorities like SEBI (Securities and Exchange Board of India) regulate Mumbai finance businesses. Strict adherence and regulatory standards help to ensure openness and consumer safety.

3. Why are Mumbai non-banking financial companies (NBFCs) are?

Though without a banking license to take deposits, financial institutions called NBFCs offer loans, credit, and asset management among other products and services. Among the prominent NBFCs in Mumbai are LandT Finance, Tata Capital, and Bajaj Finance.

4. What comes next should one apply for a loan from a Mumbai financial institution?

Through the company website or at a nearby branch, you can quickly request a loan online. Most companies also allow you to apply from their mobile apps. Keep your documents ready—income, address, and identity proof among them.

5. What is the interest rate range financial companies in Mumbai charge?

Depending on the kind of loan and company, interest charges differ. For example:

Personal loans usually cost between 10% and 20% yearly.

Usually between 7 and 9% yearly, home mortgages.

Rate variations based on other factors include your credit score, loan length, and business lending policy.