In the case of small businesses, it is also crucial to run finance operations effectively in order to ensure positive cash flow indicators and positive trends in pursuing growth. Invoicing is one of the most crucial elements of money management which makes sure that your company is receiving a reimbursement timely and each transaction is logged properly. Nevertheless, the manual paper-based invoicing may be long-lasting, inaccurate, and hard to trace.

This is where invoicing software for small businesses can be discussed as a game-changer.In the case of small businesses, it is also crucial to run finance operations effectively in order to ensure positive cash flow indicators and positive trends in pursuing growth. Invoicing is one of the most crucial fundamental of money management which makes sure that your company is receiving a reimbursement timely and each transaction is logged properly. Nevertheless, the manual paper-based invoicing may be long-lasting, inaccurate, and hard to trace. This is where the invoicing software can be discussed as a game-changer.

The top invoicing software application of small businesses automatically creates professional invoices, gives the ability to track payments, and send reminders, shows a dashboard into your earnings. No matter which of the above three you belong to, the benefits of invoicing software can include immense administrative overhead savings, better connections with the clientele, and more time to pursue your desired career path.

The variety of tools in the market has made it hard to select the appropriate invoicing software. Whether it is about the low-cost platforms to the systems with the accounting integrations, solutions are right at hand. This guide examines the best invoicing software that is specifically aimed at small businesses because these are the software options that will understand the situation of small businesses.

What Are the Best Invoicing software for Small Businesses in 2025?

- Automated Billing: Fast and error free generation and dispatching of recurring or one-off invoices, without manual input.

- Faster Payments – Use payment gateways such as PayPal, Stripe or credit cards to collect payments instantly.

- Professional Templates– Use the templates with your logo, brand colors, and company information.

- Expense Tracking- Track and code business expenses with your invoices.

- Real-Time Reporting- Real time reporting allows access to detailed financial reports to monitor outstanding payments and revenue.

- Tax Compliance- Automatically calculate GST or VAT and easily generate tax-ready reports.

- Client Management – Store customer details and accounts claims in a unified place to have convenient follow ups.

- Multi-Device Access – Download the software and use it on desktop, Tablet or mobile when you are on the move.

15 Best Invoicing Software for Small Businesses

1. FreshBooks

FreshBooks is an online invoicing and accounting system specially made to suit the small businesses, freelancer/contractor and service-based professionals. As a billing software that is known to be easy to navigate, FreshBooks makes the whole process effortless, including, composing professional invoices, monitoring payments, and submitting expenses. Users can personalize the invoices to reflect their brands, they can use recurring invoices to renew the bills to the repeat customers, and can be automatic late billing follow ups. It is also multicurrency billing, and connects to larger payment gateways such as Stripe, PayPal and credit cards, thus allowing payment to be made sooner.

In addition to invoicing, FreshBooks support time tracking, project management and expense reports. It can also offer generating real time financial information and tax ready reports which makes the business owner stay compliant and organized. It also offers a mobile app that enables you to create invoices when you are on the go allowing it to be a convenient tool to busy entrepreneurs. Be it organizing the clientele, time tracking, or financial reporting FreshBooks keeps your accounting business finances in a single seamless interface.

Key Features:

- Customization and branding of invoices is easy

- Invoices and automatic reminders

- Integrations related to payment online ( PayPal, Stripe, and so on )

- Project Billing and Time tracking

- Cost management and uploading of receipts

- Invoicing on the go mobile app

- Tax-ready and Financial reporting insights

Pricing:

- lite : $8.40/ month

- plus: $15.20/month

- premium: $26/ month

2. Zoho Invoice

Zoho Invoice is the free powerful invoicing software that suits small businesses, freelancers and entrepreneurs that desire a sleek method of invoicing without incurring extra overheads. This tool is part of the Zoho suite to be precise and it provides a clean and friendly user interface where one is able to create professional invoices, schedule payments which recur and track expenditure as well as to send auto payment reminders. It also uses multiple currencies and languages and as such would be fit to handle international clients.

Zoho Invoice can easily be integrated with Zoho Books, Zoho CRM and 3rd party applications that provide you with greater control over affairs of your finances and your clients. Its mobile application guarantees that you can prepare invoices, monitor time and send estimates even when you are on the move. The software as well provides profitable reports on receivable, revenue and collection patterns by clients. Although it is free, Zoho Invoice delivers enterprise-level capabilities that do not include any advertisement or restrictions to small business owners who are price conscious.

Key Features:

- Templates and bespoke professional invoices

- Multi-currency and multi-language supported Supports

- Billable hours and time tracking

- Automatic messages to remind payment

- Android and iOS apps

- Smooth Zoho ecosystem compatibility

Pricing:

- custom pricing

3. QuickBooks Online

The accounting and invoicing software that is most popular with small businesses is QuickBooks Online. FastBooks Online is intuitively developed and its features include invoicing, bookkeeping, tax preparation, and payroll among others. The user-friendly interface enables the users to develop tailored invoices, set up recurring payments, as well as monitor any outstanding balances easily. The software automatically records your records when you receive payments and this gives you the real-time picture of your flow.

QuickBooks Online integrates with hundreds of third party apps and banks as well and makes it easier to sync data between them and eliminates the need to enter everything manually. It does multi-currency invoicing and it contains intelligent automation such as tax calculations and payment reminders. It is scalable in nature, meaning that, as your business expands, there is an option to upgrade plans to enjoy more advanced financial tools. Being a single freelancer or having a small team, yet QuickBooks is your go to solution to organize your finances and run your operations effectively.

Key Features:

- Professional and custom invoicing

- Auto track of payments and reminders

- Integration of app and bank in real-time

- Tax tracking and reports would be made built in.

- Accessibility on the move and the view of Dashboard

- Multi-currency support

- Business-pricing based plans that can scale up growth

Pricing:

- Simple start: $1.90/ month

- Essential: $2.80/ month

- Plus: $4/ month

- Advanced: $7.60/ month

4. Wave

Wave is free, full-featured invoicing and accounting software built specifically with small businesses, freelancers, and solo entrepreneurs in mind. It offers easy and smooth platform to create endless professional invoices, track your income, expenditure, as well as receive payment online-all this with no monthly charge. Using Wave, users are able to create custom invoices, send profile invoices, and receive notifications each time a payment has been received, or late.

Integrated payment processing system sets Wave apart among many other competitors since clients can pay invoices directly through credit card or bank transfer. It also has the receipt scanning, auto-calculation of tax and real-time income tracking. With strong accounting tools able to manage payroll, financial reporting, and cash flow analysis, Wave qualifies as an all-in-one solution to any owner who seeks a cost effective easy to use solution especially to the small business.

All the basic services tools are provided free of charge, although other optional services such as payroll and payment processing services have small charges. Wave is also one of the best options to consider when one is a small business that requires a very effective tool without having to strain the bank.

Key Features:

- Declaring free unlimited invoices and accounting

- Printable templates of invoices

- Bank transfer or credit cards payments (online processing)

- Automatic tracking of tax and income

- Scanning of receipts and management of expenditure

- Dashboards and real time reporting

- Financial aid in optional payroll and premium support

Pricing:

- Starter Plan: Free

- Pro Plan: $170/year (USD)

5. Xero

A scalable cloud-based accounting and invoicing program, Xero provides small and medium-sized businesses with an intuitive user interface and a wealth of features that can be tailored to their specific needs. Using Xero, users are able to compose customized invoices, send a follow-up by automating reminders to the users, and give the user the option to make payments via Stripe, PayPal, or bank wires. It also provides a real-time summary of the health of your finances and thus managing cash flow becomes less cumbersome and more accurate.

The distinction is that Xero has a strong accounting foundation. It comes with complete bookkeeping (double-entry bookkeeping), easy bank reconciliation, and stock management—all on the same platform. Users can invite accountants or team members to collaborate seamlessly and make data-based decisions using up-to-date financial reports.

Although Xero is a premium product, it is perfect and most appropriate to small businesses that need to get an invoicing and accounting system integrated into one platform that can grow with the businesses. It also has accessibility to mobile and hence you can be able to invoice and manage your business finances anywhere.

Key Features:

- Recurring invoicing Professional bills

- Smooth bank account reconciliation and accountancy

- Role-based access to collaboration by multiple users

- Comes with 1,000+ third party apps

- Accounting of inventory and overheads Inventory and expense monitoring

- Live financial dashboards and reports

- iOS and Android app

Pricing:

- Starter: $29/ month

- Standard: $46/ month

- Premium:$69/ month

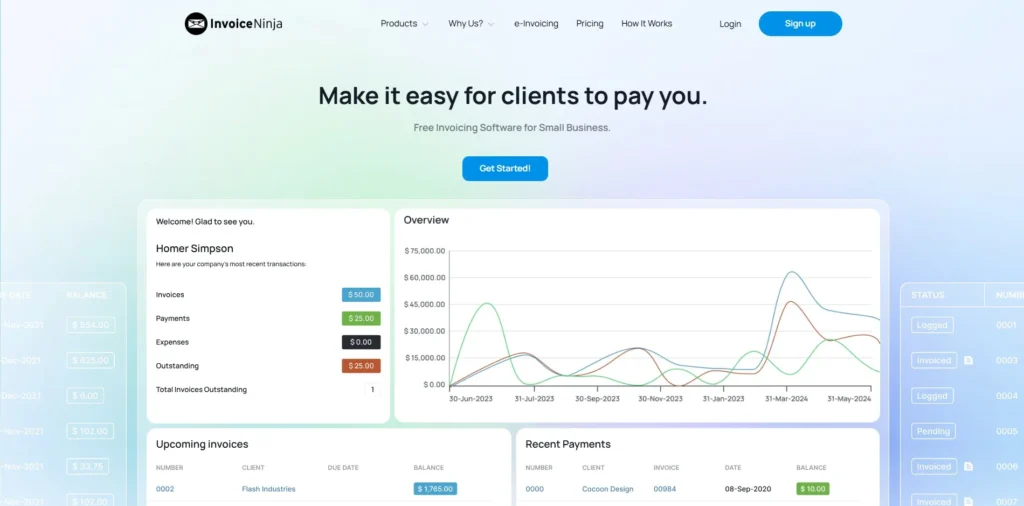

6. Invoice Ninja

Invoice Ninja is a free source (FOSS), cloud-based invoicing and billing software aimed at freelance workers and small business owners, and service providers. The fact that it has both free and premium plans makes it very lucrative, because by using it, one can send invoices to a maximum of 100 clients using 100 free invoices. This kind of software has extensive capabilities like time, project management and tracking expenses in real time.

The interface of Invoice Ninja allows one to customize it to the needs of the users, including putting company-specific branding on invoices, sending reminders, and using recurring bills. It even features more than 40 payment gateways like PayPal, Stripe, Authorize.Net to make payments rapidly. It also comes in the multi-currency and multi-language features thus ideally suitable to any company with international customers.

Self-hosted is provided to users wanting to have full control of their data and the hosted is provided with automatic updates and backups. Uniting flexibility, price-friendliness, and the advanced set of features, Invoice Ninja can be a good solution for an expanding business, in need of powerful opportunities of invoicing.

Key Features:

- Unlimited clients plan at no charge

- Personalized invoices and logoed templates

- Built in payment gateways (40+ choices)

- Time, tracking, and task management

- Multi-currencies and multi-languagesMany crypto-currencies have expanded beyond single currencies to support multiple currencies. The same applies to multiple languages.

- Self-hosting, open-source software

- Auto-reminder and recurring bills

Pricing

- Free Plan: $0/year

- Ninja Pro: $10/month (billed annually)

- Enterprise Plan: $160/year

7. Bonsai

Bonsai is a one-stop business management and invoicing tool specifically designed to help freelancers, soloprenurs and small creative agencies. Its invoicing feature streamlines the client billing process and has functionalities such as professional templates that one can use, automatic reminders when payments are not made, recurring invoices, and smooth connectivity with payment portals such as Stripe, PayPal, and ACH transfers.

In addition to invoicing, Bonsai also contains contracts, proposals, time tracking, task management, and client CRM-so it is a complete suite of tools regardless of what they do. The users are able to create workflows where invoices are automatically created on the basis of the time which they keep track of or project milestones. Its tax assistant calculates quarterly estimates of taxes and prepares tax reports thus saving time when it comes to filing.

Another feature of bonsai is its financial components meaning that it has a tool to track income and costs, allowing freelancers to get a full picture of business wellbeing. It is simple, portable, and it suits the needs of service-oriented professionals, who are interested in having more time devoted to work and less on administration.

Key Features:

- Professional templates of invoices

- Automatic subscription, and payment reminders

- Integration of time and project tracking

- Tax assistant and reporting financial side

- Online payment by Stripe, PayPal, ACH

- Proposals, task management and Contracts

- Freelance one-stop business web-application

Pricing:

- Basic – $9/user/month

- Essentials – $19/user/month

- Premium – $29/user/month

- Elite – $49/user/month

8. Invoicely

Invoicely is an easy-to-use, yet mighty web-based invoicing application built to fit freelancers, startups, and small companies. It provides its basic invoicing offer under a free plan and a premium plan to serve advanced requirements. With the new HUB we combine the ability to generate and email professional invoices within minutes, to track time and billable costs, to get paid online through various payment gateways.

Invoicely helps companies to customise their invoices, add taxes, shipping,and discounts and administer numerous clients with a central dashboard. It also has multi-currency and multi-language invoicing, that is handy in global operations. Invoicely provides the opportunity to track all the activities within the accounts and create a report of income, expenses, and taxes-therefore one can easily have a clear picture of the money.

It is web-based, accessible on mobile phone, which entails that you can carry out invoicing anywhere and at any time. Individuals and startups with limited set budgets will also find Invoicely to be a good solution because of its low price and ease of use.

Key Features:

- Basic invoicing plan that is free of charge

- Individual, branded templates of invoices

- Tracking of expense, mileage, and time

- Multi-currency and multi-language allowed Multi-country Integration

- Integrations of payment online (PayPal, Stripe, etc.).

- Financial and taxes reports

- Mobile-friendly dashboard

Pricing

- Basic Plan – $9.99/month

- Professional Plan – $19.99/month

- Enterprise Plan – $29.99/month

9. Billdu

Billdu is a contemporary billing and expenses management program designed and developed to meet the needs of small business proprietors and freelance workers and professionals. It will provide you with clean invoice templates, options to send invoices repeatedly, estimates on the fly and online payment capacity via a clean, and mobile friendly interface. Billdu can keep your business ahead of billing on the road, or in the office.

Users can send invoices through email, SMS messages or even using a share link using Billdu. It has the ability to receive payments on the invoice via PayPal, Stripe, or credit cards directly. The platform also provides automatic invoice reminding and communications with clients, and this helps to sustain professional relationship with the clients.

Billdu also offers solutions to track inventory, manage purchase orders, and financial reporting on top of invoicing. Its mobile application is especially an efficient one, allowing creating and handling invoices even when there is no connection to the internet. Being easy to navigate, but with strong features, Billdu is a great choice not only for the individuals who seek speed and mobility.

Key Features:

- Invoice generation and tracking on mobile first BASIS

- Templates of branded invoices and estimates

- Except payment over the internet (Stripe, PayPal, etc.)

- Set reminders and tracking of deliveries

- Purchase order and inventory management

- Data sync offline matriculation

- CRM and client communicating features

Pricing:

- Lite: $4.99/ month

- Standard: $9.99/ month

- Premium:$ 19.99/ month

Finf Best: AI Agents for Ecommerce

Bookkeeping Software for Small Business

10. Fiverr Workspace

It is an intelligent invoicing and business management tool built by Fiverr which is catered towards freelancers and small business owners. It simplifies invoicing and enables you to customize a professional, branded invoice in minutes and automate everything like recurring payments, reminders to make payments when late, etc. AND.CO perfectly incorporates PayPal and Stripe payment systems helping their users to receive payments quicker.

The differentiating factor, however, is that it is an all-in-one. Other than invoicing, it has features that deal with time tracking, contracts, proposals, task management, and expense tracking. This assists freelancers to carry out their whole workflow on a single platform. Taxes, expenses, and earnings are also reported in the software automatically so it is never really difficult to stay organized during tax season.

AND.CO has a simple and mobile-oriented design, making it a perfect tool to use if you are a freelancer, and you wish to carve less time on what the admins do, and devote more time at offering quality services. Its simple interface and automation abilities enable its user to be at peace knowing they are being professional and being paid at the right time.

Key Features:

- Automated, branded billing

- Billings and payment reminders

- PayPal/Stripe integration

- Implicit agreements/proposals

- Correspectively, monitoring and tracking Time Management

- Automated expenses/tax reports

- Dashboard and mobile app that is user-friendly

Pricing:

- Unlimited: $18/ month

11. Hiveage

Hiveage is a cloud solution aimed at facilitating small companies, freelancer and agencies who require simple and quick invoicing and payment collection. It is visually clean and its simple features complement it to make it smack perfect in a sense that it does not require you to be an accountant to use it. Hiveage helps with branding, quotations, recurring billing, and current invoicing.

Other features provided by the platform include expense tracking, time billing, and mileage logs, as well as team collaboration. It is compatible with various payment gateways such as PayPal, Stripe, Square, and Authorize.Net where one can receive payments with more speed. Users have real-time feedback on outstanding invoices and received payment in the dash which helps them have a clear picture of their cash flow.

It also has a flexible scalable pricing structure depending on the number of your clients, which is suitable to a growing business. It is a good option for the service providers that require an effective invoicing module without being burdened with additional features. Hiveage is simple, automated, and fast, as an invoicing tool that lets you spend your time on what matters quality delivery to your clients.

Key Features:

- Quick and easy invoice making

- Recurring Invoices, auto-billing

- Time, cost and mileage accountancy

- Multi language support We support payment gateways of several languages.

- Custom quotes/estimates

- Income and payments in real-time tracking

- Cooperation among teams

Pricing (Monthly):

- Free: $0 (5 clients)

- Basic: $16 (50 clients)

- Pro: $25 (250 clients, 5 team members)

- Plus: $42 (1,000 clients, 10 team members)

12. PayPal Invoicing

PayPal Invoicing is an integrated application of PayPal which enables small businesses, freelancers and entrepreneurs to instantly compose and deliver invoices to customers all across the globe. The best thing about it is that it fits any user who has already adopted PayPal as the method of receiving payments because the connection is flawless and does not need additional tools. With some clicks, you are able to create personalized invoices, provide itemized services, charge taxes and also give discounts.

The clients may pay either with PayPal account, credit/debit card, or bank transfer, even when they do not have PayPal account. The tracking of payments is automatic and the user once an invoice is paid gets a real-time notification. It is also possible to generate recurrent bills and reminder to the client concerning the unpaid bill.

PayPal is a reputed and internationally ranked money-exchange platform, which is why it is easy to establish credibility among clients. Multi-currency invoicing is also displayed where freelancers and companies that are based in other countries are ideal. An easier, set up-free, payment processing built in ready-to-use solution, PayPal Invoicing allows the rapidity of easy, sound billing.

Key Features:

- Included and in PayPal at no charge

- Invoice ease of customization and itemization

- Various payment methods to the clients

- Automatic and notification of payment tracking

- Every bill and reminders

- Multi-currency–invoicing support

- Global payment infrastructure that is trusted

Pricing:

- Custom pricing

13. Square Invoices

Square Invoices is an effective, simple to use payment, invoice tool of a company known as Square that is primarily described as a payment processing provider. It enables small business owners, freelancers and service professionals to create and receive electronic invoices/estimates/recurring bills fast, easily and save on paper and office space. You are able to make custom invoices, set due dates, add tax, and have clients pay online via a credit card, ACH, and other means of payment.

The Square Invoices also enables deposits, tipping, and regular pre-defined arrangement of invoices, which makes it ideal in the event of organizations that have periodic clients or subscription services. The solution has real-time tracking as well as alert features when clients viewing or paying an invoice. It also comes with an all-in-one business solution as it is perfectly incorporated with Square POS system, inventory, and CRM software.

The app enables the user to maintain invoicing on the go and reporting tools will enable the view on paid, outstanding and overdue invoices. Unless you need advanced functionality, Square invoices is highly recommended due to its free monthly basic invoice fee, and competitive per-transaction rate, plus the functionality of being able to on-the-go billing.

Key Features:

- Tailorable paperless invoices and quotes

- Enable credit card, ACH and mobile payments

- Recurring billing and deposits

- Invoices tracking in real time and notifications

- Integration with Square ecosystem Seamless

- Android and iOS mobile invoicing

- Zero monthly rate on basic functions

Pricing :

- Free: $0

- Plus: $49

- Premium: $149

14. Sage Invoicing

Sage Invoicing belongs to the Sage Business Cloud system which is aimed at small and developing companies that require higher efficiency in the sphere of billing and accounting systems which are cloud-based. It allows one to simply create invoices professionally, automate regular bills, as well as accept payments through online means, and integrates well with other accounting and payroll functions of Sage.

There is full invoice customization on the platform, your company logo, payment terms, and taxes. Observation of unpaid invoices, reminders, and real-time notifications when receiving payments are made are possible. The Sage dashboard is handy and can provide an immediate overview of the financial situation of your business in terms of cash flow, and outstanding debts.

Combined with powerful compliance tools, and tax calculation and reporting features, Sage Invoicing is particularly suitable to businesses that need to issue invoices and engage in sophisticated accounting all within the same self-contained ecosystem. Whether it is a once-off project, or a subscription-based service, Sage will keep you on track and bill on time.

Key Features:

- Standard, business bills

- Automated billing and progress of payment Auto-recurring billing and payment tracking

- Online up-to-date communication and reminders

- Sage accounting and payroll compatible

- Tax computation, and reporting of compliance

- Mobile, clouds-based

- Financial dashboards and tracking cash flow

Pricing:

- Custom pricing

15. Harvest

Harvest is a time-tracking and invoicing application that is ideal to freelancers, agencies and small teams billing clients at a time or a project level. The most obvious advantage of it is time tracking which can be easily integrated with invoicing- users can turn tracked hours to an invoice within a few clicks. It is thus perfect to be used by professionals who would like to be paid by accurately tracking billable time rather than manually calculating time.

Harvest allows you to create invoices with customized messages, define recurring billing charges as well as accepting online payment through Stripe and PayPal. Project budgeting, expense tracking, and detailed reporting are also supported on the platform so you can keep track of earnings as well as expenses. This is because clients can make payments against invoices with immediate effect via the email that they receive.

Harvest can be paired with well-known project management apps such as Asana, Trello, and Basecamp and streamline the workflow. Its mobile applications guarantee you to track the time and create invoices when on the move. Harvest gives free and paid plan which will depend on the size of your business.

Key Features:

- Time accounting with invoicing

- Send customized invoices

- Stripe and PayPal online payments

- Tracking of expense and project budget tracking

- Granular reporting and analytics

- Project management integrations

- iOS app and Android

Pricing:

- Pro: $11/seat/month

- Premium: $14/seat/month

Conclusion

Selecting an appropriate invoicing software may largely affect your financial well-being and efficiency of the small company. As a freelancer, consultant, or small business owner, an efficient invoicing platform is a sure way to get payments on time, make professional contact with clients and track finances properly. There are accounting packages with all the frills such as QuickBooks and Xero, and free ones with tremendous potential such as Wave and Zoho Invoice.

The accounting market has something to offer every budget and business need. One should seek automation, mobile access, payment integration and reporting as the main features to work with selecting the best fit. At the end of the day the right tool will also save you time spent in administration and allow you to work more on the expansion of business. Make an analysis of priorities- whether it is simplicity, scalability or integration and select the software that connects with your workflow and objectives.

FAQs

Which free invoicing software is good to use by small business?

Among the highly-rated free invoicing tools, one can count Wave and Zoho Invoice.

Does invoicing software allow me to accept online payments?

Right, the majority of platforms support PayPal, Stripe, and credit card rest processors.

Which is the recurring billing system invoicing software?

Such tools as FreshBooks, QuickBooks and Square Invoices propose recurring invoicing.

Are payments handled on invoicing software safe?

Indeed, encryption and payment security standards would be standard for reliable tools.

Am I able to use invoicing software on my mobile?

Of course–the vast majority of invoicing software provide iOS and Android mobile applications.